Insurance Appraisal Services | Fair, Fast, and Final Claim Resolutions

Mendy was professional and did an amazing job. I had no idea what to do and he handled everything. I highly recommend Panther PA if you need help with a claim. They are the best!

— Carol Redlich

Expert Insurance Appraisal Services That Work for You

When your insurance company underpays—or stops negotiating entirely—insurance appraisal services can help you break the deadlock and secure a fair outcome. Panther Public Adjusting offers fast, expert-led appraisal representation for policyholders, attorneys, and public adjusters across Florida and beyond.

Appraisal is a powerful, policy-backed process that puts your dispute in the hands of experienced professionals—not the courtroom.

What Is an Insurance Appraiser?

An insurance appraiser is a neutral party selected to resolve disputes over the value of an insurance claim. If you’ve hit a wall with your carrier, you may be able to invoke the appraisal clause in your policy.

Here’s how it works:

You choose an appraiser

The insurance company appoints their own

Together, the two appraisers select a neutral umpire

The panel evaluates the damage and issues a binding decision

Appraisal offers a smarter, faster alternative to litigation—without sacrificing results.

Maximize Your Insurance Payout: Understanding Appraisal in Florida

Why Choose Insurance Appraisal Instead of a Lawsuit?

Faster resolution – Appraisals typically settle in weeks, not years

Lower cost – No retainer fees or drawn-out court filings

Neutral review – Decisions are made by experts in construction, scope, and valuation

Higher payouts – In many cases, the final award exceeds both the insurer’s and public adjuster’s original estimates

Who We Represent

Our insurance appraisal services are trusted by:

Homeowners & landlords

Condominium owners & HOAs

Commercial property managers

Public adjusters

Insurance attorneys

Whether your claim involves a single-family home or a large commercial complex, we have the skill and strategy to deliver results.

Trusted by Public Adjusters and Attorneys Across Florida

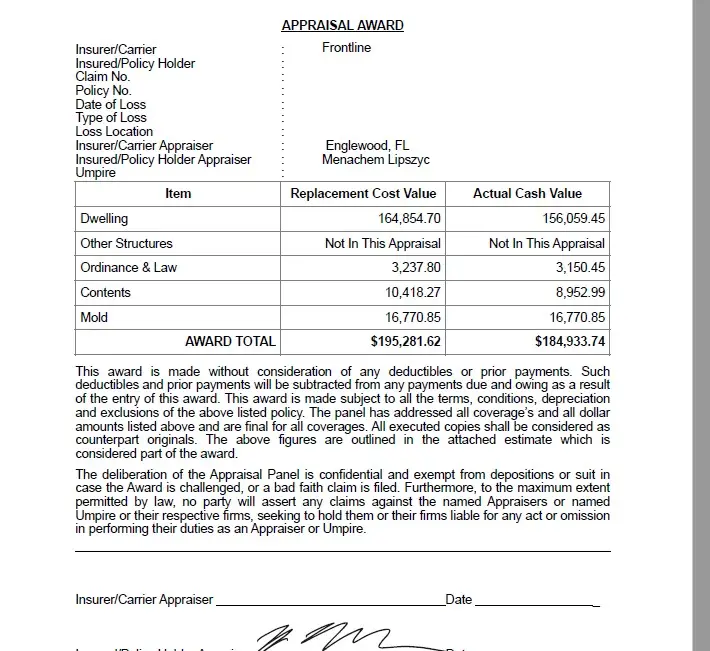

Here’s an example of what we do:

An attorney hired Panther Public Adjusting to act as the insurance appraiser on a disputed residential claim. Before we got involved, the situation looked like this:

Frontline Insurance’s estimate: $32,000

Public Adjuster’s estimate: $42,000

Once we inspected the property ourselves, we identified major areas of scope that both the insurer and even the PA had missed. Our thorough documentation and comprehensive estimate uncovered:

Undiagnosed water damage to cabinets

- Damaged flooring not initially addressed

Structural impact requiring code upgrades

Damaged stucco not originally addressed

Final result? An appraisal award of $195,281.62

That’s the power of a proper insurance appraiser.

EXPOSED: The Truth About Denied Roof Claims & How to Appeal Successfully!

Our Insurance Appraisal Process

Case Review – We evaluate your claim history and confirm that appraisal is the right path

Damage Inspection – We conduct our own independent survey

Estimate Preparation – Using Xactimate or Symbility, we prepare a detailed line-item estimate

Appraiser Coordination – We work with the opposing appraiser and help select a fair umpire

Binding Resolution – We advocate for your position and finalize a legally enforceable award

EXPOSED: The Truth About Denied Roof Claims & How to Appeal Successfully!

Why Choose Panther for Insurance Appraisal Services?

Nationwide availability and experience with all claim sizes

Trusted by public adjusters and insurance law firms

Fast, professional communication and case updates

We don’t recycle scopes—we uncover and document what others miss

Ready for a Fair Settlement Without Going to Court?

If your insurer has made an offer far below what your contractor, public adjuster, or appraiser believes is fair—and communication is going nowhere—appraisal may be your best option. It’s especially effective when both parties agree that coverage applies, but disagree on the amount.

Insurance appraisal can deliver the resolution you’re looking for—without the stress of legal battles. Whether you’re a policyholder, public adjuster, or attorney, Panther Public Adjusting is your go-to resource for professional insurance appraisal services.

📞 Call: 833-726-8437

📧 Email: Claims@PantherPA.com

📝 Request an Appraisal Consultation »

Explore More Claim Solutions:

FAQs About Appraisal

How long does an insurance appraisal take?

While timelines vary depending on the complexity of the claim and the cooperation of all parties involved, most insurance appraisals take between 2 to 6 months. That’s significantly faster than litigation, which can drag on for several years. Choosing an experienced insurance appraiser helps streamline the process.

How much does an insurance appraisal cost?

Costs vary depending on the appraiser and the size of the claim. Some appraisers offer budget services starting around $1,000, but results often reflect the fee—you get what you pay for. While many appraisers charge hourly, Panther Public Adjusting provides a clear, flat-rate quote up front, so there are no surprises.

How does insurance appraisal work?

Insurance appraisal is a process used to resolve disputes over the value of a property damage claim. Each party hires an appraiser. The two appraisers then select a neutral umpire. After reviewing the damage and estimates, the panel agrees on a final settlement amount—typically binding and enforceable.

What is an appraisal in insurance?

An insurance appraisal is a dispute resolution method included in many property insurance policies. It allows homeowners and insurers to settle disagreements over claim value without going to court. The process results in a fair, independent valuation based on evidence and expert input.

What is the difference between an insurance adjuster and an insurance appraiser?

An insurance adjuster evaluates and processes your claim—either on behalf of the insurance company (staff or independent adjuster) or the policyholder (public adjuster). An insurance appraiser, on the other hand, steps in when there’s a dispute and provides an independent valuation. Appraisers do not negotiate; they participate in binding dispute resolution.

Can I choose my own insurance appraiser?

Yes. If your policy includes an appraisal clause, you have the right to choose your own appraiser. It’s important to select someone experienced, detail-oriented, and reputable. At Panther, our team is regularly hired by attorneys and public adjusters for our appraisal expertise.

Do I need a lawyer to go to insurance appraisal?

No lawyer is required for the appraisal process. In fact, many policyholders opt for appraisal instead of litigation because it’s simpler, faster, and usually less costly. That said, if you’re already working with an attorney, they may recommend Panther Public Adjusting as your appraisal expert.

What types of claims can go to appraisal?

Most property damage claims—residential or commercial—can go through appraisal, including losses from hurricanes, fires, hail, plumbing issues, and more. Panther handles appraisal cases for condos, HOA communities, apartment complexes, and commercial buildings across the U.S.

Is insurance appraisal available in most policies, and what should homeowners know about it?

Yes, many standard property insurance policies include an appraisal clause, but many policyholders don’t realize it’s there. It allows you to dispute the amount of loss without filing a lawsuit. Knowing this clause exists gives you powerful leverage when your claim is underpaid.

How do I know if insurance appraisal is the right next step?

If your insurer has made an offer far below what your contractor, public adjuster, or appraiser believes is fair—and communication is going nowhere—appraisal may be your best option. It’s especially effective when both parties agree that coverage applies, but disagree on the amount.

Can the appraisal process resolve disputes about coverage or liability?

Appraisal typically focuses only on the amount of loss, not coverage disputes. However, this can depend on the state you’re in and the language in your insurance policy. In some jurisdictions, appraisers and umpires may consider limited coverage questions tied to scope.

Should the umpire be selected before the appraisers disagree?

Absolutely. From experience, it’s much easier and more efficient to select a neutral umpire early in the process—before tensions rise or an impasse occurs. This helps avoid delays and ensures smoother resolution when final decisions need to be made.