How Our Client’s Hurricane Ian Claim Went from $42k to $250k!

When disaster strikes, homeowners count on their insurance companies to provide fair compensation for damages. Unfortunately, that’s not always the case. At Panther PA, we specialize in fighting for policyholders who have been lowballed or wrongfully denied by their insurers.

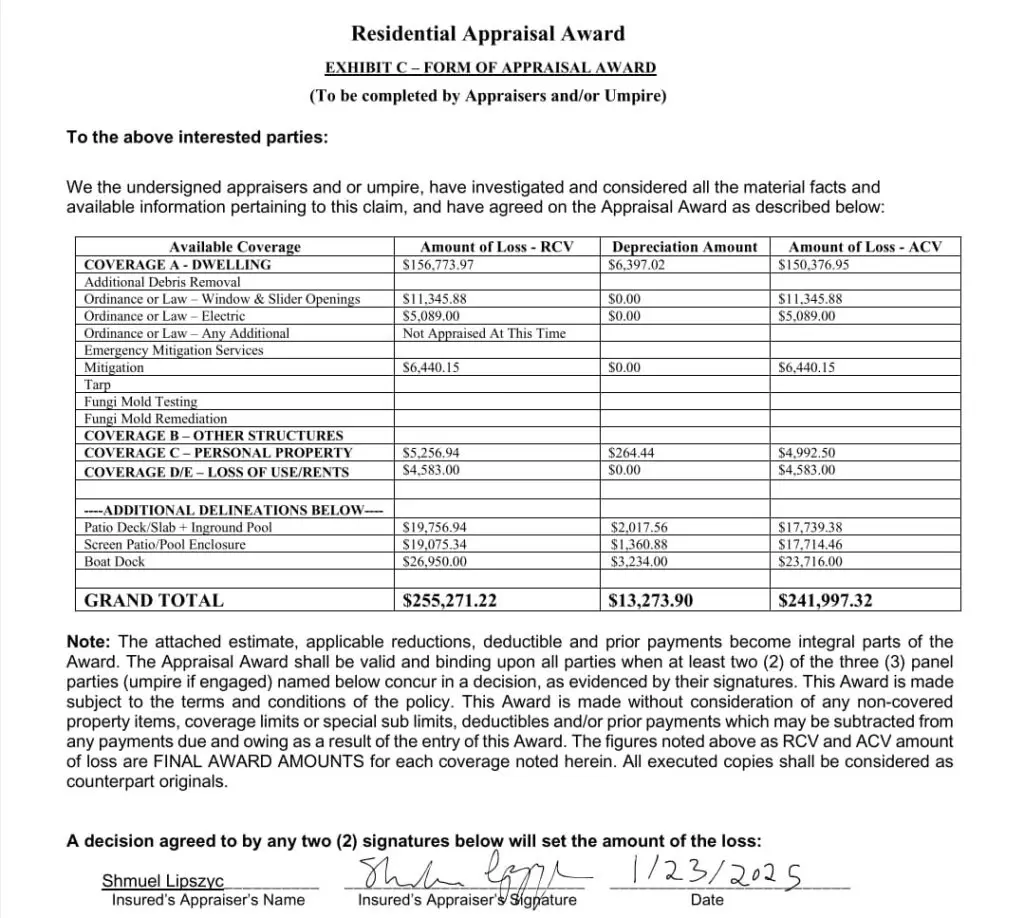

One of our recent success stories highlights exactly why hiring a public adjuster can make all the difference. Our client, a homeowner affected by Hurricane Ian, was initially offered just $42,000 for their property damage. But thanks to the relentless efforts of our team, we were able to increase their settlement to over $250,000—five times what Citizens Insurance originally offered!

If you’re wondering whether your insurance claim was underpaid, keep reading to learn how we fought for this client—and how we can help you, too.

The Problem: A Severely Underpaid Hurricane Ian Claim

After Hurricane Ian tore through Florida, thousands of homeowners faced extensive property damage. Many expected their insurance providers to cover the full cost of repairs, but lowball settlements and unfair denials became all too common.

Our client experienced this firsthand when they filed a claim with Citizens Insurance for hurricane-related damage. Despite the significant destruction, Citizens only offered them $42,000—an amount that barely covered a fraction of the necessary repairs.

Frustrated and unsure of their options, the homeowner reached out to Panther PA for help.

💡 Think your claim was underpaid? Let us review it for free! Contact us today.

The Solution: Panther PA Reopens the Claim & Fights for Fair Compensation

At Panther PA, we believe that homeowners deserve every dollar they’re entitled to under their policy. After reviewing the claim, our expert public adjuster, Shmuel, and desk adjuster, Mushka, immediately saw that the initial settlement was far too low.

Here’s how we turned things around for our client:

- Reopened the Claim – We gathered additional evidence to prove the full extent of the hurricane damage.

- Pushed for a Fair Settlement – Our team negotiated aggressively with the insurance company, ensuring our client’s damages were properly evaluated.

- Used the Appraisal Process – When the insurer resisted, we escalated the claim to appraisal, a formal dispute resolution process that led to a massive payout increase.

The result? A final settlement of over $250,000—more than 5 times the original offer!

📞 If your claim was underpaid, call us today at 833-726-8437 for a free review!

Why You Shouldn’t Accept a Lowball Offer from Your Insurance Company

Many homeowners accept the first offer from their insurance company, assuming it’s the best they can get. But the reality is that insurers often underpay claims to save money.

Here’s why you should always consider having a public adjuster review your claim:

✅ Insurance companies prioritize profits – They may minimize payouts to protect their bottom line.

✅ You might be owed much more – Without expert representation, you could leave thousands of dollars on the table.

✅ Public adjusters work for YOU – Unlike insurance company adjusters, we fight for policyholders, not the insurer.

Don’t settle for less than you deserve. Let us review your claim and maximize your payout!

💡 Get started today—schedule a free consultation.

How Panther PA Can Help You Recover the Full Value of Your Claim

At Panther PA, we specialize in helping homeowners and business owners fight back against underpaid and denied insurance claims. Whether you’re dealing with hurricane damage, fire damage, water damage, or another disaster, we have the expertise to maximize your settlement.

Our services include:

✔ Claim Reviews – We assess your claim to determine if you were underpaid.

✔ Policy Analysis – We ensure you get the full benefits outlined in your policy.

✔ Negotiation & Appraisal – We handle all communications with the insurance company.

✔ Faster Resolutions – We work quickly to secure your settlement as soon as possible.

👉 Find out if your claim was underpaid—contact us today!

Think Your Claim Was Underpaid? Call Panther PA Today!

Our client’s story is proof that you don’t have to accept an unfair settlement. If you suspect your claim was lowballed or wrongfully denied, you need a strong advocate on your side.

📞 Call 833-726-8437 now for a free claim review!

📩 Or request a consultation online: https://pantherpa.com/#contact/

Let Panther PA fight for the full settlement you deserve!

Related Articles:

- Military Veteran Recovers $180K After Low Insurance Payout

- Vandalism or Violence? Winning the Insurance Battle!

- How I Turned $618 into $68,000 for Wendy—The Power of Public Adjusting!

🚀 Don’t leave money on the table—call us today!